Commercial property finance tailored to fit your business.

Commercial mortgages

Secure up to £10 million to help your business reach its property goals. Speak to our expert business relationship management team today.

Borrow between £150k - £10m

Fast decision-making

Up to 80% loan to value

Relationship manager

Rapid decisions made by real people.

Whether you’re buying a business premises, investing in property, or refinancing an existing business mortgage, our relationship managers will work closely with you to understand the unique needs and strengths of your business.

And we know how important speed and clarity can be. Once you’ve made an application, our expert team will work fast to move things along as quickly as possible.

Commercial owner-occupied mortgage

Commercial investment mortgage

To be eligible, your business must have two full years of financial accounts and be either a Limited Company or LLP registered at Companies House, or a partnership or sole trader that operates in England, Scotland or Wales.

Businesses can include those trading from freehold/long leasehold property in England, Scotland and Wales e.g. offices (including professional practices), industrial units, mixed-use, warehouses, factories, retail, hotels, guest houses, restaurants, public houses, convenience stores and children’s day nurseries. Security will be required.

For more information, read our tariff of fees, our mandatory information checklist or our fixed rate breakage costs facts sheet.

How can a commercial mortgage help my business?

- Own your premises – stop renting and take more control of your costs and future.

- Raise capital – release capital to invest in growth elsewhere by refinancing your commercial property.

- Generate income – invest in property to target capital growth or use it as a source of rental income.

- Diversify your business – spread your risk and broaden your revenue streams.

We’re giving established businesses the banking they deserve

Transforming relationship banking with great rates, smart people and powerful technology. It’s a new take on an old idea – just like our orange hats.

See the difference a better bank can make

This mascot-maker expanded their premises with Allica's help

Relationship Manager: Martin Parker Location: South East

This pub is saving £1,000 a month by remortgaging with Allica

Relationship Manager: Matt West Location: South East

Kinder City nursery bought their premises so that they could invest in it and grow

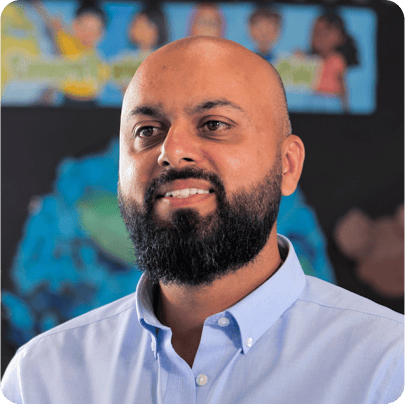

Relationship Manager: Wahid Nawaz Location: South East

Allica Bank made Fuel Accountancy a mortgage offer in just seven days

Relationship Manager: Matt West Location: South West

Ashley Care Group purchased their fifth care home within just six weeks

Relationship Manager: Eugene Vichare Location: South East

Enquire now

Speak to our team about how we could help your business with a commercial mortgage.

Please ensure you meet our eligibility criteria.