Six months ago, Allica Bank Asset Finance was launched to the market. Since the day we first started building it, our goal was to make an asset finance proposition that – alongside putting the interests of customers first – is simple and straightforward. Asset finance that focuses on giving brokers and their customers the freedom to get on with doing business, rather than wasting time on unnecessary admin.

It’s been a busy few months, to say the least, but also incredibly rewarding. We received double the amount of applications in June than we did in May, and application growth continues to be strong.

Our brokers are really beginning to trust us with their best customers. For example, in June we had a customer that needed to urgently access their assets. Thanks to our tech-driven approach – sending out documents by email, using electronic signatures, and managing it through our bespoke asset finance platform – and the hard work of our team, we were able to have the money in their account just 48 minutes after they signed the document. And this was a transaction for £500,000! A very happy broker and a very happy customer.

Alongside growing demand, we continue to adapt and hone our offering in response to ongoing feedback from our broker community.

One way we gather this feedback is in the form of a periodical survey of our asset finance broker panel. And I’m pleased to be able to share the results of our inaugural survey with you today.

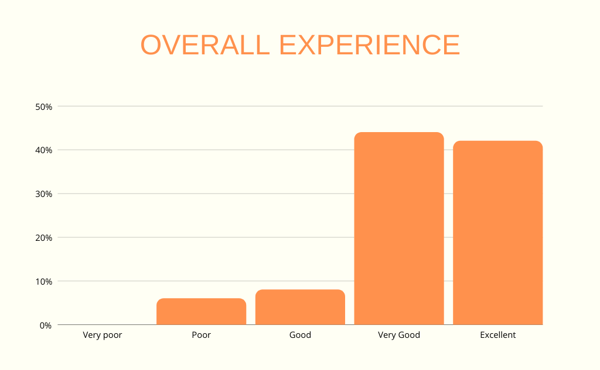

This survey took place in late-May and early-June and received 36 responses. It asked our brokers to rate different aspects of our service as either Very Poor, Poor, Good, Very Good or Excellent, and gathered various pieces of qualitative feedback, too. I’ve broken down some of the key findings below.

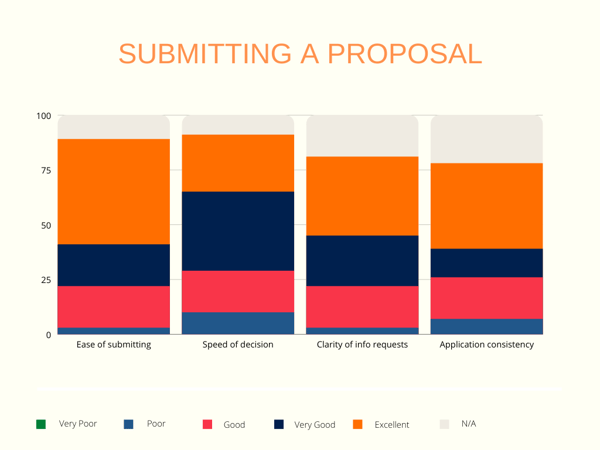

Submitting a proposal

Proposal submissions shouldn’t be difficult, and it’s therefore pleasing that nearly 50% of our brokers said the ease of doing so with Allica was ‘Excellent’, with 97% giving a positive response overall. Similarly, 97% of brokers said the clarity of our additional information requests was ‘Good’, ‘Very Good’ or ‘Excellent’.

Where there is clearly more room for improvement is the speed of decision-making, with 10% rating this as ‘Poor’. Rest assured, we are already reviewing our internal processes to explore how we can speed this up, and we have already added new people to the team to boost our capacity.

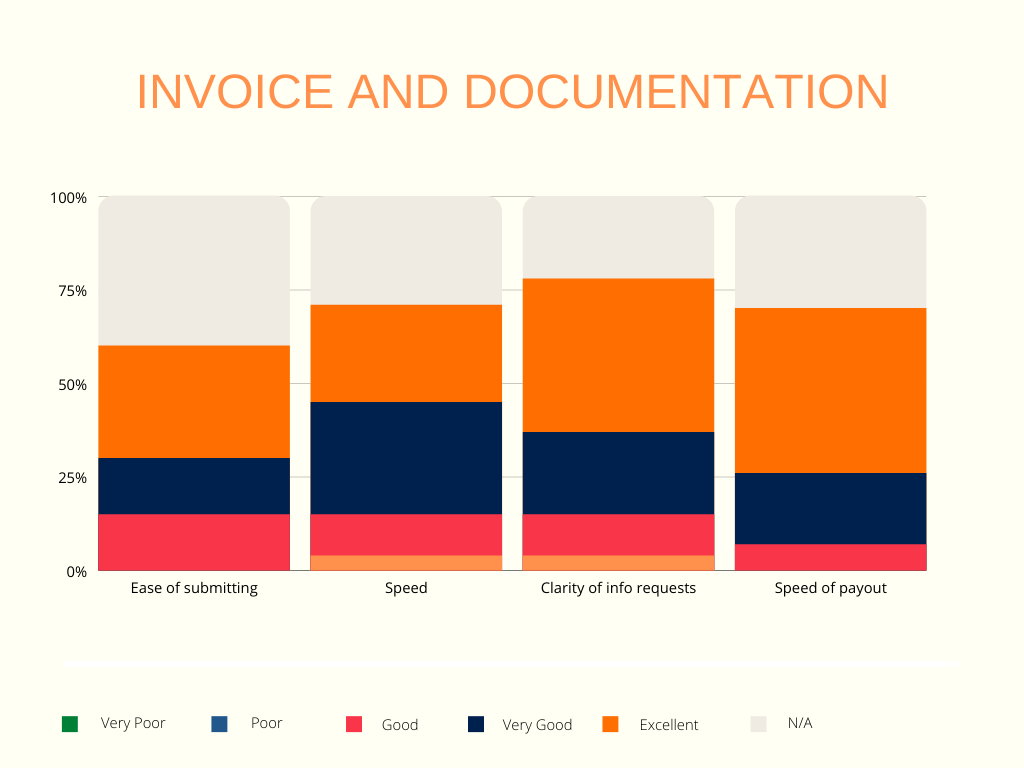

Invoice and documentation

This has been a stand-out priority for me and the team, as we know how information requests and paperwork can be a real bugbear for brokers and clients throughout the lending process. As such, it was pleasing that on all metrics measured around our invoice and documentation processes – including ease, speed and clarity – we received 100% positive feedback.

I believe part of this is down to implementing Direct Debit deposits, meaning there’s no need for clients to pay invoices up front, and using electronic identification and document signing to really speed things up. Also, we’ve received really strong feedback from brokers due to paying out commissions on the activation of a deal, rather than needing to send an invoice in, which has always been an unnecessary faff at other lenders.

Next, it’s a matter of exploring how we turn those ‘Good’ and ‘Very Good’ ratings into ‘Excellent’, and there are plenty more enhancements on the way to achieve this.

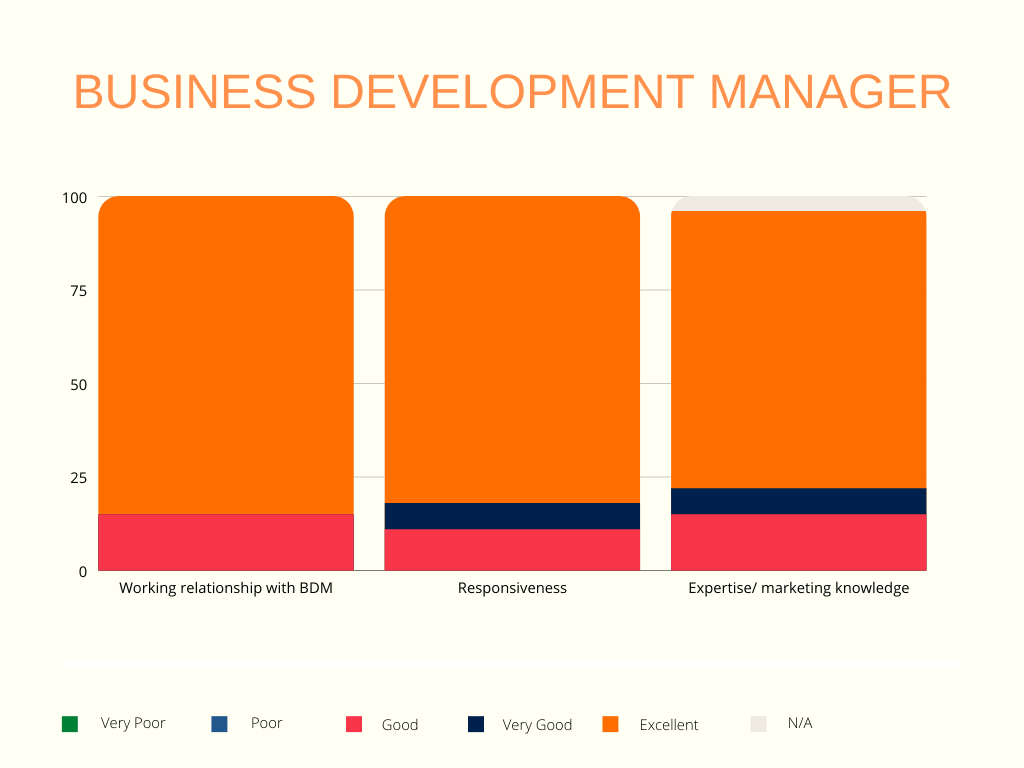

Business Development Managers

This is what I am most proud of. The relationships our brokers have with our amazing team of business development managers was rated as ‘Excellent’ by 85% of our broker panel, with the remainder rating their business development manager as either ‘Good’ or ‘Very Good’. What a result!

The personal attention and expertise of our team is such a core part of the Allica Bank service, and it’s great to know we’re getting that right.

Similarly, the two other metrics measured in this area – responsiveness and expertise – also both got 100% positive feedback. A massive well done to my whole team!

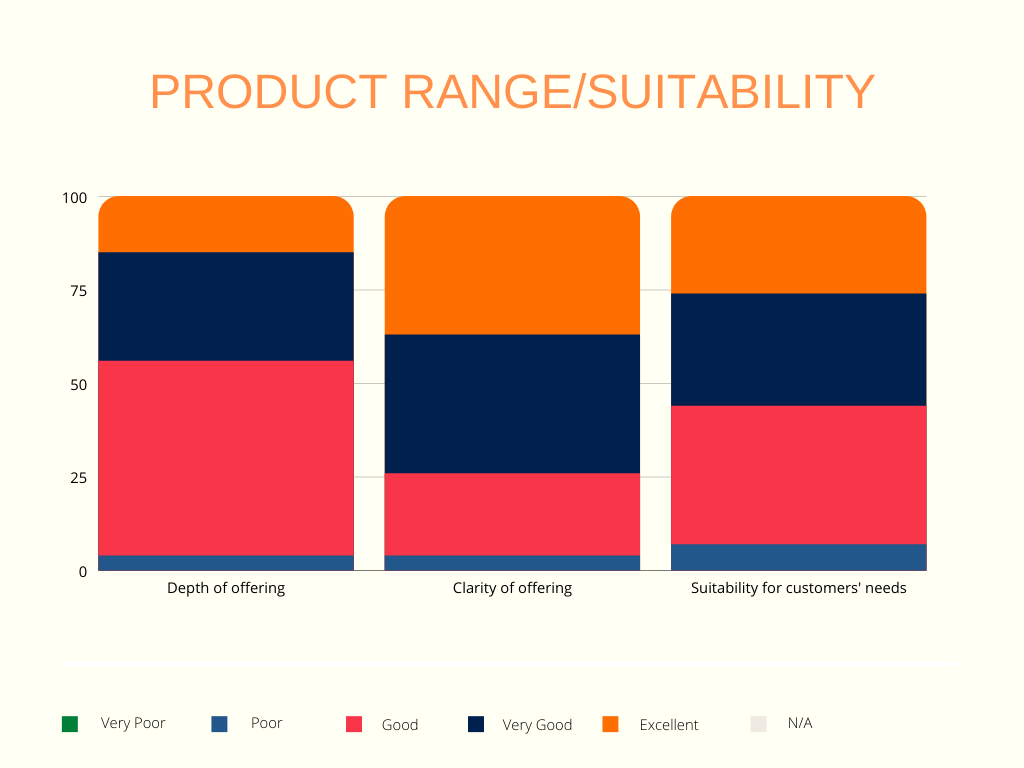

Product range and suitability

The depth of our offering and its suitability for the needs of our brokers’ clients’ both rated positively by over 93% of our broker panel. This is a fantastic return considering Allica Bank Asset Finance initially launched to market with only hire purchase as an option.

However, the concentration of ratings was predominantly in the ‘Good’ and ‘Very Good’ categories, and it’s now my mission to push as many of these up to ‘Excellent’ as possible in the months ahead. One way we have tried to do this is by adding sub-hire to our offering, which was one of the most requested features by our broker panel in the survey.

Overall experience of Allica Bank

Finally, we asked our broker panel to rate their overall experience of Allica Bank, with 86% of brokers responding with either ‘Very Good’ or ‘Excellent’.

This is a fantastic set of results, and the whole team should be extremely proud of that achievement. However, with our ambition to create the best asset finance broker proposition available in the market, our attention now turns to how we can improve the experience for the remaining respondents that responded with either ‘Poor’ or ‘Good’.

What now?

It’s always a little nerve-wracking sending out a survey for the first time, but I could not be happier with the results. The positive sentiment shown by our broker panel is proof that we’re clearly getting something right. However, there was also loads of incredibly valuable constructive feedback, which the team is already hard at work addressing.

I mentioned we recently launched sub-hire, which we prioritised based on feedback received from our broker panel both through their relationship manager and our broker survey. We are also constantly reviewing our processes and exploring how technology can speed up the experience and reduce any unnecessary admin and/or paperwork for you and your clients.

That just leaves me to say thank you to those on our broker panel that completed the survey. Your responses have been hugely enlightening. This is what makes sure we’re addressing the right things in the right way and at the right time.

I look forward to seeing the results of the next one!