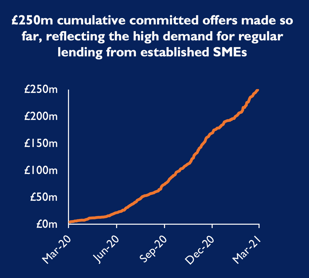

- Since Allica Bank first opened its doors to SME lending in March 2020 – and despite the challenging COVID environment - the bank has supported SMEs across the UK with £71m of completed loans and a further c.£120m of committed lending offers currently in the process of completion. 85% of this lending is to businesses outside of London.

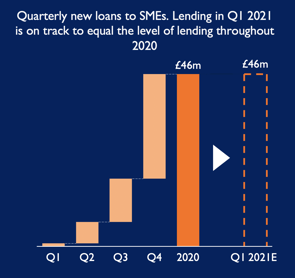

- Momentum in lending continues to build at pace – the bank is on track to complete as much lending in the first quarter of 2021, as in the whole of 2020.

- Lending growth – backed by the bank’s strong funding capability – is set to increase through 2021. Allica Bank anticipates it will make over £500m in committed lending offers in 2021.

- Driving efficiencies through a clear proposition and digital portal has resulted in an industry leading 24-hour turnaround in processing loan applications.

- Allica Bank’s expanding SME proposition is gaining significant recognition across the industry:

- Voted Commercial Mortgage Lender of the Year in November 2020

- 100% of commercial finance brokers rate Allica Bank as Excellent, Very Good or Good (86% rate Allica Bank as Very Good or Excellent)

- Launched new Asset Finance proposition at end of 2020

- Well-advanced plans to launch new direct service for SMEs in 2021, including recruitment for the UK’s first branchless national network of relationship managers

- Awarded Best New Savings Provider by MoneyNet in January 2021

Chief Executive of Allica Bank, Richard Davies, commented:

“Allica Bank has delivered a strong performance in our first year, supporting Britain’s entrepreneurs and SMEs during these challenging times with our new lending and expanding service-driven proposition.

“We have seen phenomenal growth across our lending products, especially commercial mortgages, with a significant increase in SMEs and brokers selecting Allica Bank as their lender of choice.

“Whilst the majority of attention in the market has been on the COVID lending schemes, we have seen high demand for regular lending from established SMEs – and we expect this trend to continue to increase.

“Allica Bank’s most recent broker survey found 93% of brokers fear a lack of commercial mortgage availability this year, and some 82% of brokers have seen a reduction in the supply for finance from business lenders since the start of the pandemic, with more than half describing it as ‘significant’.

“We continue to drive efficiencies and enhanced service to customers through optimising our modern technology infrastructure, with loan applications consistently processed within 24 hours.

“As focus shifts to the recovery, Allica Bank is extremely well positioned to help brokers and Britain’s community of established SMEs strengthen and scale their businesses. In 2021, we will continue to develop our products and services, including investing in our new national relationship manager network and building on the recent launch of our Asset Finance proposition.

“We remain intensely focused on our ambition to reimagine local relationship banking for SMEs, combining our leading technology capability with excellent personal service and re-doubling our efforts and ability to become banking partner of choice to Britain’s SMEs and brokers.”

About Allica Bank

Allica Bank is dedicated to serving and supporting small and medium businesses and empowering them to succeed. We combine modern, powerful technology with local relationships in the community to deliver expert banking for business Britain.

We offer businesses market-leading lending products including commercial mortgages and asset finance, as well as a range of business and retail savings products and services. We are working hard on developing a full suite of banking services to help Britain’s businesses flourish and grow.

Allica Bank received full banking authorisation in September 2019 and is authorised by the Prudential Regulation Authority, and regulated by the Financial Conduct Authority and the Prudential Regulation Authority.

Allica Financial Services Register number – 821851.

Allica Bank is backed by Warwick Capital Partners